Consoles are persistently popular in Japan … Game Age Research Institute, live service game user trend analysis report released | GameBusiness.jp

Continue to provide new experiences to users by continuing to add new content and hold in-game events even after the game is released.live service games. In recent years, many games released in the game industry use this method to keep users from getting bored over the long term.

Against this background, Game Age Research Institute conducted a survey of console/PC game users playing live service games, mainly in Asia, and started selling trend analysis reports.

Game Age Research Institute releases live service game user trend analysis report in 9 countries centered on Asia-live service game usage rate on domestic consoles is 79.8%

Recently, the term “live service game” has been attracting a lot of attention in the game industry. A live service game is a game that continues to provide new experiences to users by continuously adding new content and in-game events even after the game is released. This includes many online games. In addition to games played on PCs, many games played on consoles, including online games, have been released recently.

Therefore, Game Age Research Institute conducted a survey of console and PC game users who are playing live service games mainly in Asia, and started selling reports.

Approximately 19.32 million live service game users in Japan

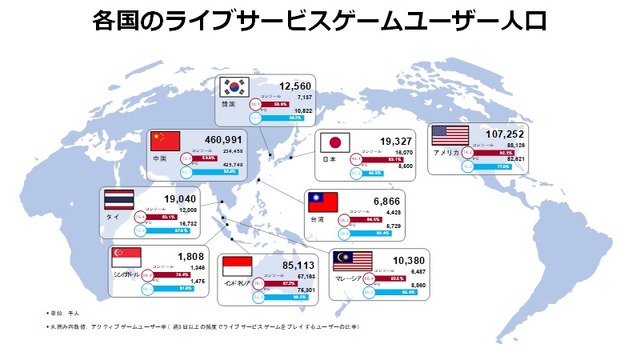

The following is a global map of “number of live service game users” excerpted from the report.

Among the four East Asian countries (Japan/Korea/China/Taiwan), China has a large population of 460.99 million, the United States with 107.25 million, and among the four Southeast Asian countries (Thailand/Singapore/Indonesia/Malaysia), Indonesia has 85.11 million. of live service game users.

Japan has the highest percentage of users playing live service games on consoles at 79.8%, and China has the highest percentage of users playing live service games on PC at 90.5%. Among the nine countries targeted this time, Japan is characterized by the overwhelmingly higher ratio of playing on consoles than on PC.

In addition, all four Southeast Asian countries have more PC game users than console users, with the highest percentage of PC users in Indonesia at 87.1%. In Southeast Asia, more than 60% of active users play at least 3 days a week on both console and PC.

Released a live service game user trend analysis report for 9 countries, mainly in Asia

The research focuses on understanding the latest market trends for console and PC live service games (online games for operated businesses).

[Report type]

- Global summary report

This report focuses on differences in trends between countries and regions. - Country/Region Reports

It is a report that adds in-depth consideration focusing on the difference in trends by game cluster

based on the data in each country/region.

Users are clustered into hardcore/midcore/core by cross-tabulating “game playing frequency” and “game spending”.

- With many survey items that cover a wide range of actual conditions, the content is easy for live service game users to understand!

- [Survey area]9 countries/regions (Asia: 8 / North America: 1)

- East Asia: Japan/Korea/China/Taiwan

Southeast Asia: Indonesia/Malaysia/Thailand/Singapore

North America: America

【Investigation period】

- March 10th (Friday) to April 4th (Tuesday), 2023

[Survey target person conditions] - [Screening survey]

Residents of survey target countries/regions aged 15 to 49 (male and female)

[Main survey]

(1) Playing live service games 3 or more days a week

(2) have played any of the major live service game titles;

* Regarding the scale estimation, weight back aggregation is performed by gender age (5-year age group) according to the population distribution of each time and region.

[Report contents]

“Global MAP” live service game population in each country

Average age of “Global MAP” live service game users

“Global MAP” annual game market size

“Global MAP” STEAM annual market size

demographics

owned device

game play device

game play frequency

Average gameplay time per day

discretionary entertainment expenses

Experience with major game portals

Experience playing major titles

Experience with major game portals

Experience playing major titles

Game software purchase/play status

thoughts on billing

Consumption of major game portals

Billing object

Consumption for peripheral devices

“Additional content” purchase status

Peripheral device purchase status

Frequently purchased “additional content”

Favorite game genre (online games)

localization needs

game sources

Purchase experience of “game-related goods”

customer journey

Recognition and Favor of Corporate Brand

Game values

Corporate image (by company)

Motivation for playing games

Corporate image (by keyword: reverse lookup)

Number of people playing online games

Gaming PC Ownership/Purchase Intention

online game partner

Favorite brand of gaming PC

favorite gameplay style

Spread of high-spec PCs

Communication during gameplay

About “ping value”

Purchase price range of online game software

About esports

time to buy online games

Viewing status of “game commentary/delivery”

Attractive discount rate

Recognition and understanding of trend words

Console/PC Priority

Recognition and play status of major NFT game titles

Consumption trends for consoles/PCs

Billing experience for F2P gamesFor more information about this report, please contact Game Age Research Institute’s official website or email us.