On February 24, Dentsu announced its “Advertising Expenditures in Japan in 2022,” estimating total advertising expenditures in Japan and advertising expenditures by medium and industry. In 2022 (January-December), Japan’s total advertising expenditure will be strong against the backdrop of the digitalization of society, despite being affected by various factors in Japan and overseas, such as the resurgence of the new coronavirus infection, the situation in Ukraine, and soaring prices. The market as a whole was supported by the growth of “Internet advertising expenses”, which was 7,102.1 billion yen (104.4% compared to the previous year) for the whole year.

Dentsu has released a research report on Japan’s advertising expenditures in 2022, “2022 Japan’s Advertising Expenditures.” The total advertising expenditure in 2022 will be 7,102.1 billion yen (104.4% of the previous year), surpassing 2019 before the corona disaster. Furthermore, it surpassed the record high of 7,019.1 billion yen set in 2007, reaching a record high since estimates began in 1947.

[Trends in total advertising expenditure in Japan]

The first half of the year was strong due to the easing of restrictions on movement following the recovery from the coronavirus pandemic and the Beijing 2022 Winter Olympics and Paralympics. In the second half of the fiscal year, despite the impact of major changes in the economic environment due to the situation in Ukraine and changes in monetary policies in Europe and the United States, as well as the re-expansion of the novel coronavirus, we saw a gradual recovery in social and economic activity.・Advertising demand increased, mainly for “Leisure”. Especially against the backdrop of the digitalization of society, the overall advertising market has grown due to strong Internet advertising expenses.

Internet advertising expenditure was 3.0912 trillion yen (114.3% of the previous year), an increase of approximately 1 trillion yen in just three years from 2019 when it exceeded 2 trillion yen. Demand for video advertising, centered on in-stream advertising, continued to rise from the previous year, and the expansion of digital promotions also contributed to market growth. Total advertising spending in 2022 is said to have increased due to strong growth in Internet advertising.

Of the advertising expenses (TV media digital) for Internet media services mainly provided by TV media broadcasters, the estimated range is advertising expenses for Internet video distribution, such as missed TV programs and real-time distribution services. “TV media-related video advertising expenses” showed a high growth of 35 billion yen (140.6% compared to the previous year). Demand for advertising has increased against the backdrop of the expansion of connected TV use and the enrichment of program content with high planning and editing capabilities, such as large-scale sports broadcasts and topical dramas.

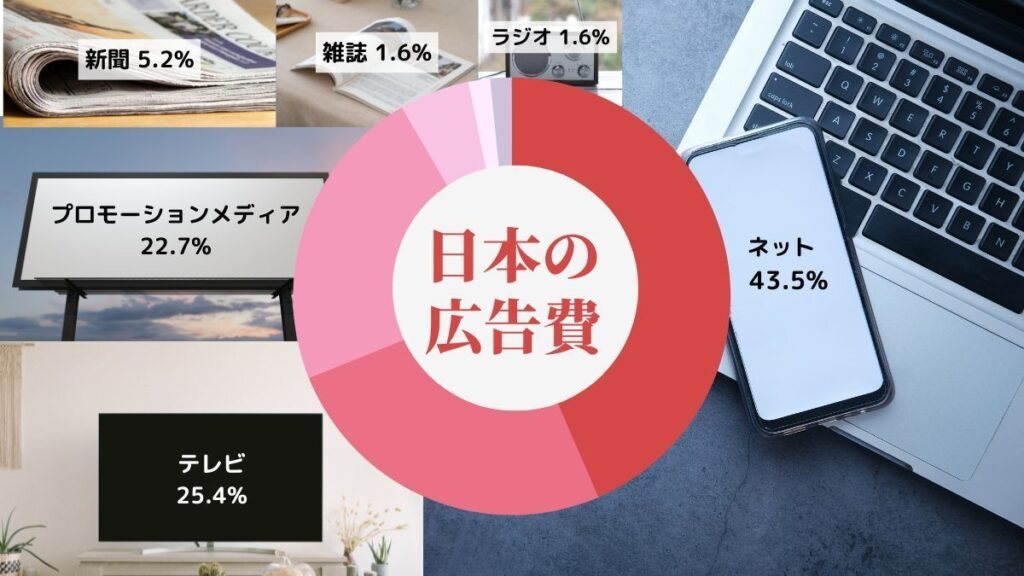

“Advertising expenditures in Japan” consist of (1) advertising expenditures for the four mass media (total of advertising expenditures for newspapers, magazines, radio, and television media; each advertising expenditure includes production costs), (2) Internet advertising expenditures (Internet advertising expenditures Media expenses, product sales EC platform advertising expenses, Internet advertising production expenses), ③ Promotional media advertising expenses (outdoor, transportation, inserts, DM[direct mail]free papers, POP, events / exhibitions / video, etc.) ) are roughly classified into three categories, and an overview of each category is summarized.

[Advertising expenses by medium <2020-2022>]

Advertising expenses for the four mass media were 2,398.5 billion yen (97.7% of the previous year). Although “radio advertising expenses” increased, “newspaper advertising expenses”, “magazine advertising expenses” and “TV media advertising expenses” decreased.

Internet advertising expenditure was 3,091.2 billion yen. Against the background of the digitalization of society that continued from the previous year, it was a double-digit growth of 114.3% compared to the previous year. Internet advertising expenses (total of Internet advertising media expenses, product sales EC platform advertising expenses, and Internet advertising production expenses) accounted for 43.5% of total advertising expenses. It increased by 1 trillion yen, becoming a market of 3 trillion yen. “Internet advertising media expenses” increased 115.0% year-on-year to 2,480.1 billion yen, and “television media-related video advertising expenses” increased sharply to 35.0 billion yen (140.6% year-on-year) for the second consecutive year, especially as the use of connected TVs expanded. bottom. “Internet advertising production costs” increased to 420.3 billion yen (up 9.2% year on year) due to the expansion of the video advertising market and the increase in the number of advertisements produced in programmatic advertising. In addition, “advertisement expenses for product sales EC platform” also increased to 190.8 billion yen (up 17.0% year on year) due to the continued increase in home demand.

It should be noted that “advertising expenses for product sales-related EC platforms” in this survey are not the overall “Internet advertising expenses for promoting sales in the EC area”, but “store openings” on EC platforms that sell goods. It is defined as the advertising expenses invested within the platform by a business operator.

Promotional media advertising expenses were 1,612.4 billion yen (98.3% of the previous year). With the recovery from the corona disaster, restrictions on movement were eased and nationwide travel support measures were implemented by the national and local governments. On the other hand, due to the return of the flow of people, some media exceeded the previous year, such as “outdoor advertisements”, “traffic advertisements” and “insert advertisements”.

・Internet advertising media expenses

Internet advertising media expenses increased significantly from the previous year to 2,480.1 billion yen (up 15.0% from the previous year), despite being affected by the situation in Ukraine, the weaker yen, and soaring raw material prices. In particular, increased demand for video ads, centered on in-stream ads, contributed. The use of digital technology in corporate sales promotion activities has progressed, and listing advertisements and digital sales promotions have also been strong.

Digital advertising expenses (part of Internet advertising media expenses) derived from the four mass media were 121.1 billion yen, up 14.1% from the previous year, a double-digit growth following the previous year. Newspaper digital was 22.1 billion yen (103.8% compared to the previous year). The Beijing 2022 Winter Olympics and Paralympics, the 26th House of Councilors regular election, and the FIFA World Cup Qatar 2022 contributed to boosting advertising expenses.

Magazine digital was 61 billion yen (105.2% compared to the previous year). Continuing from the previous year, the number of PV (page views) / UU (unique users) of major web media and the number of followers of major SNS increased. Data solutions utilizing DMP (data management platform), SNS utilization measures, online events, advertiser owned content production, video production and distribution, etc. Projects that leverage the publisher’s data, content production capabilities, and community power. This has greatly boosted the growth of the publishing web media and magazine brand content business. In addition, we are engaged in “publishing IP (intellectual property)” such as commercialization of fan community, expansion of comic business, XR (cross reality) and metaverse areas, trading of high-value content using NFT (non-fungible token). Various research and development have been carried out by making full use of

Radio digital was 2.2 billion yen (157.1% of the previous year). Audio media such as podcasts continued to attract attention, and new and continued placements were seen in radio digital advertisements, including radiko. Sales of premium audio ads were also strong.

TV media digital was 35.8 billion yen (140.9% compared to the previous year). Among TV media digital, “TV media-related video advertisements” increased significantly from the previous year to 35 billion yen (140.6% compared to the previous year). Topical dramas also contributed to TVer’s steady increase in both the number of views and the number of users. ABEMA also recorded a record WAU (Weekly Active Users) during the FIFA World Cup Qatar 2022 and expanded its scale.

・Product sales EC platform advertising expenses

Product sales EC platform advertising expenses in “Japanese advertising expenses” were 190.8 billion yen (117.0% year-on-year)

was. As the use of e-commerce platforms for product sales has become established among consumers, the number increased for the second consecutive year. Sales of daily necessities and foodstuffs were strong, and the distribution volume of cosmetics, fashion, travel, and sports-related products increased as opportunities to go out gradually increased after the declaration of a state of emergency and priority measures to prevent the spread of the virus were lifted.

・Internet advertisement production cost

Internet advertising production costs were 420.3 billion yen (109.2% of the previous year). With the establishment of online consumption style and full-scale digitization of companies, the demand for Internet advertisement production has increased. By type of production, the growth of web video ads was remarkable, and in particular, the number of in-stream video ads displayed in content such as video sites and apps increased significantly.

・Newspaper advertising expenses

Of the four mass media advertising expenses, newspaper advertising expenses were 369.7 billion yen (96.9% of the previous year). Although the Beijing 2022 Winter Olympics and Paralympics, the 26th House of Councilors regular election, and the FIFA World Cup Qatar 2022 contributed to boosting advertising expenses, the economic environment changed due to the resurgence of COVID-19 and the situation in Ukraine. Due to the backlash of the Paralympic Games, etc., it decreased for the whole year.

By industry, “transportation/leisure” increased 17.8% compared to the previous year, recovering from the slump caused by the corona crisis. Not only leisure facilities and entertainment-related, but also travel, lodging, and transportation industries grew significantly, and increased for the whole year. On the other hand, “Pharmaceuticals/Medical Supplies” decreased by 88.1%, mainly medicines for seniors, and “Information/Communication” decreased by 91.8%, mainly by computers in reaction to the COVID-19 pandemic.

・Magazine advertising expenses

Magazine advertising expenses were 114 billion yen (93.1% of the previous year). Estimated sales of paper publications decreased by 93.5% year-on-year. The breakdown was 95.5% for books and 90.9% for magazines compared to the previous year. On the other hand, the electronic publishing market continued to grow by 107.5% year-on-year, surpassing 500 billion yen. The overall publishing market, which includes paper and electronic publications, was 97.4% of the previous year’s level, falling below the previous year’s level for the first time in four years.

Magazine advertising expenses remained below the previous year’s level throughout the year, reaching 93.1% of the previous year’s level. By industry, “transportation/leisure” increased due to the easing of restrictions on movement accompanying the recovery from the corona disaster and the implementation of nationwide travel support measures by the national and local governments. On the other hand, “cosmetics/toiletries”, which has a high share of magazine advertising expenses, continued to decline from the previous year.

・Radio advertising expenses

Radio advertising expenses were 112.9 billion yen (102.1% of the previous year), surpassing the previous year for the whole year. By industry, “fashion/accessories” (122.5% year-on-year) and “restaurants/various services” (113.4% year-on-year) following the recovery from the corona disaster, and “cosmetics/toiletries” (117.3% year-on-year) following the previous year. ) increased significantly.

・Television media advertising expenses

Television media advertising expenses (terrestrial television + satellite media related) were 1,801.9 billion yen (98.0% of the previous year). In terms of terrestrial television (1,676.8 billion yen/97.6% of the previous year), program (time) advertising expenses will be used for the Beijing 2022 Winter Olympics and Paralympics, the FIFA World Cup Qatar 2022, as well as domestic professional baseball and professional golf tournaments. Although large-scale sports competitions and various events were broadcast, demand did not increase enough to offset the reactionary decline caused by the Tokyo 2020 Olympic and Paralympic Games and the final Asian qualifiers for the FIFA World Cup Qatar 2022. By region, sales in the Osaka, Nagoya, and Fukuoka districts exceeded the previous year’s levels for the full year.

In the January-March period, spot advertising expenses were driven by placements in the human resources field, and “restaurants and various services” performed well. However, in the April-June period, the “information and communications” sector was sluggish, and the shortage of semiconductors and rising raw material prices due to the situation in Ukraine added to the impact, and the same situation continued through the July-September quarter. In the October-December period, in addition to the strong performance of “restaurants and various services,” signs of recovery were seen in “automobiles and related products,” which had been affected by the shortage of semiconductors. did not reach the level. By region, sales in all eight key districts fell below the previous year’s level for the full year.

In satellite media (125.1 billion yen / 103.5% of the previous year), the mail-order market continues to perform well. Spot demand also increased, surpassing the previous year. The three new BS stations contributed to the activation of BS media.

・Outdoor advertising

Outdoor advertising was 282.4 billion yen (103.1% year-on-year). The trend toward a recovery in the flow of people became noticeable, and along with that, advertising expenses remained firm. Ad placements recovered, mainly in urban areas, and advertising demand increased, mainly in industries such as luxury brands and entertainment. Demand for long-term billboards increased due to changes in advertisers and contract extensions for large media installed in downtown areas. Short-term billboards, short-term network billboards, and outdoor visions increased as demand concentrated on large, impact-type OOH media that stand out in downtown areas. Continuing from the previous year, 3D content broadcasting became a hot topic.

・Traffic advertising

Transit advertising was 136 billion yen (101.0% year-on-year). In railways, demand for both posters and digital signage continued from the previous year to concentrate on impact-type OOH media set in locations with a large number of people at major stations rather than network media. Nationwide, large-scale digital signage exceeded the previous year. Domestic flights recovered slightly after the lifting of restrictions on movement following the declaration of a state of emergency. Taxi advertisements continued to increase from the previous year, partly due to the addition of new taxi companies capable of developing signage advertisements.

・Folding

Insertion was 265.2 billion yen (100.8% compared to the previous year). It continued to be used as a medium to boost stay-at-home and at-home demand, and remained above the previous year’s level until September. From October onwards, sales promotion activities decreased due to soaring costs of energy and raw materials, including electricity and paper costs, and sales were sluggish, but overall sales exceeded the previous year. By industry, distribution and retail, including supermarkets, home centers, and home appliance mass retailers, increased. Continuing from the previous year, purchasers in the service industry performed well. Travel and hotel demand also recovered significantly. As in the previous year, mail-order sales were strong for manufacturers, and sales increased significantly. Finance and insurance remained at the same level as the previous year.

・DM (direct mail)

DM was 338.1 billion yen (98.1% of the previous year). Advertising demand for home-based DMs for individuals and office-based DMs for BtoB sales has run its course, resulting in a decline. With the easing of refraining from going out, there was an increase in transportation/leisure-related items such as tourism/travel, mail-order sales, and finance/insurance. As in the previous year, there were many personalized DMs using data marketing and DMs linked to digital measures. Unaddressed direct mail, mainly for public notices and various announcements, has been used as a means of approaching a group of people who cannot be covered by other media such as Internet advertisements and mass media.

·free paper

Free paper was 140.5 billion yen (97.4% of the previous year). Advertisements related to the 26th regular election for members of the House of Councilors contributed greatly. On the other hand, the impact of COVID-19 and high prices continued, and although industries such as finance, housing/real estate, job information, gourmet/restaurants recovered, the circulation and frequency of publication decreased, resulting in a 97.4% increase compared to the previous year. . Free newspapers, which mainly contain regional information, showed signs of recovery in advertisements aimed at attracting customers to restaurants, commercial facilities, department stores, etc. in the regions where they were issued.

・POP

POP was 151.4 billion yen (96.2% of the previous year). Although we saw the use of digital signage, which is highly cost-effective for advertisers, two-way communication tools typified by measures to use smartphones, and hands-on POP measures that take advantage of the strengths of real stores, the overall number of implementations was low. advertising expenses fell below the previous year.

・Events, exhibitions, videos, etc.

Events, exhibitions, videos, etc. were 298.8 billion yen (92.5% of the previous year). The event area decreased to 123.3 billion yen (89.9% year-on-year) in reaction to the Tokyo 2020 Olympic and Paralympic Games in the previous year. In the exhibition area, advertising demand increased due to the holding of various exhibitions, the renovation and renovation of entertainment facilities such as department stores, commercial complexes, corporate PR facilities, theme parks, and special events, but the overall demand decreased. In the video-related field, the production demand for distribution videos accompanying online exhibitions, web lectures, seminars, etc., and product service introductions continued to increase from the previous year. Cinead (Cinema Advertising) saw an increase in advertising demand for luxury brands as movie theaters resumed operations and many blockbuster films were released.

The commercial printing market was 1.775 trillion yen (99.7% of the previous year) as an advertising-related market that is not included in the “Japanese advertising expenditure” market. Within the commercial printing market, the printing market for posters, leaflets, and pamphlets decreased slightly to 1.065 trillion yen (99.5% of the previous year). Although printing companies tried to pass on the cost of raw materials (paper, ink, plates, etc.) and energy-related costs, advertising expenses decreased due to the reduction in printing lots, downsizing, and the number of times of printing.

The posting market was 138.7 billion yen (108.1% of the previous year). Continuing from the previous year, social demand for all-house distribution continued due to the impact of the new corona and alternative media, etc., and increased to 138.7 billion yen. We continue to receive inquiries about handouts and announcements related to public offices and local governments. Local job information, gourmet/restaurant, cram school/education, housing/real estate, home delivery, etc. increased, mainly in major metropolitan areas.

The DM production-related market was 110.3 billion yen (103.0% of the previous year). Planning and production work increased from the previous year, as DM was used as an alternative to person-to-person sales and as a sales promotion tool for remote sales. In addition, operational expenses, including data marketing, also increased.