“OreAra” deploys ads localized in various languages ”Gakumasu” tops SoV for Japanese YouTube mobile game ads in May Sensor Tower survey | gamebiz

Sensor Tower said:[レポート]The company announced the release of “Insights into Global Mobile Game Advertising Trends.”

Ad distribution is an important strategy for mobile games to rapidly develop the market and continue to gain popularity in the market. The popular games in the United States, Japan, and South Korea in 2024 all rank at the top of the mobile game ad exposure rate (SoV) on each platform. The “2024 Global Mobile Game Advertising Trends Insights” report analyzes mobile game ad distribution through trends in the SoV of major ad distribution platforms, top mobile game publishers, and popular creatives in the United States, Japan, and South Korea markets by mobile game genre.

*This report only includes IAP estimates of app store revenue and does not include advertising revenue or revenue from third-party Android markets in mainland China. Mobile game ad SoV (Share of Voice) refers to the percentage of exposure of a mobile game ad compared to the total exposure of all mobile game ads on that platform.

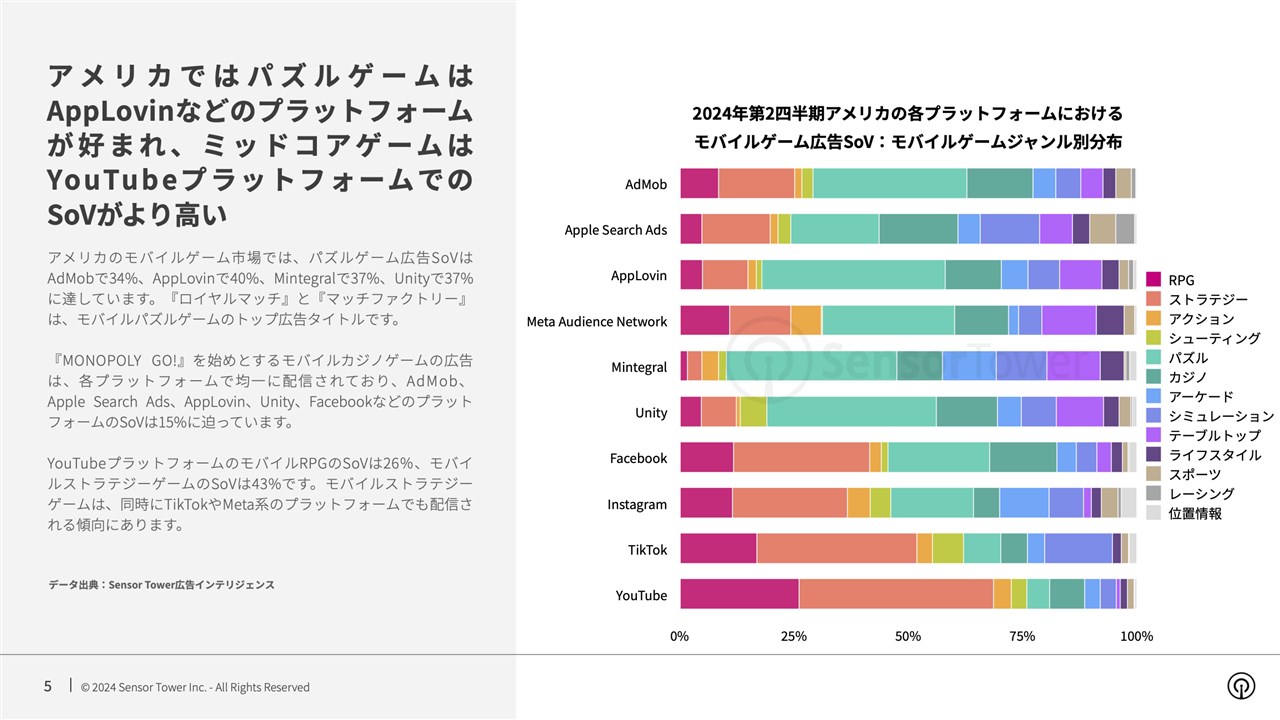

■ In the United States, people prefer to distribute puzzle games through platforms such as AppLovin

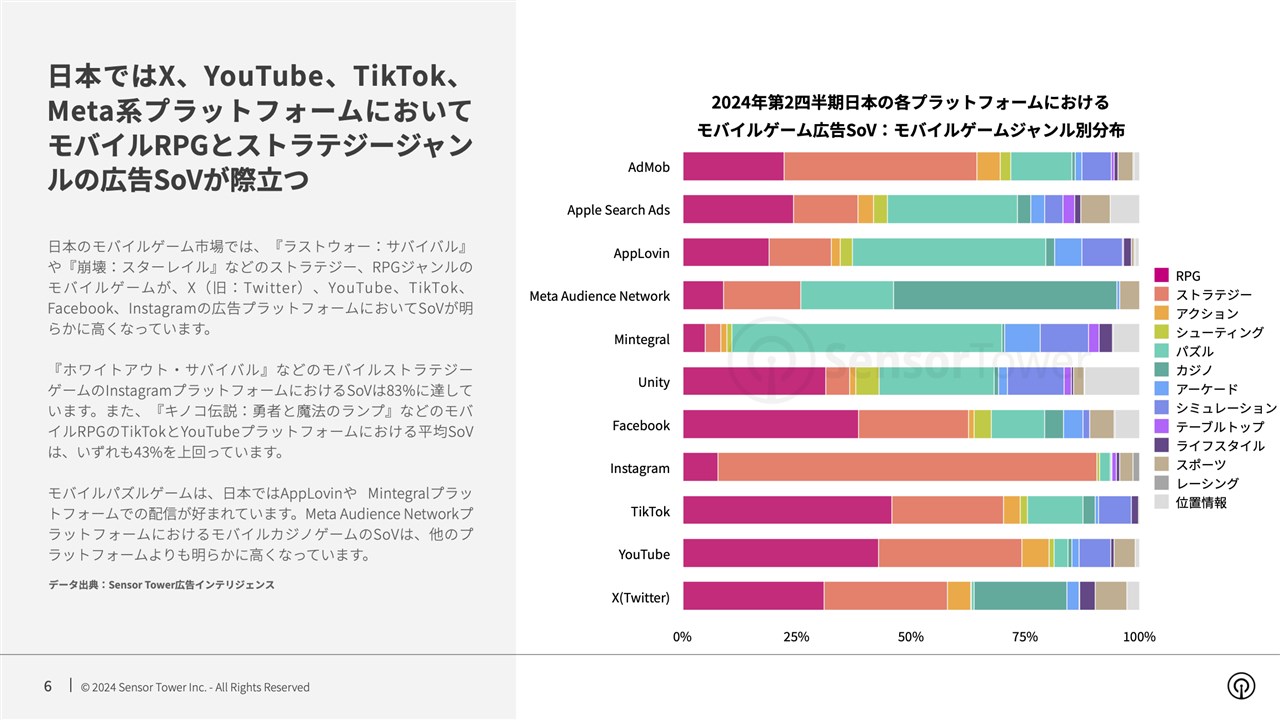

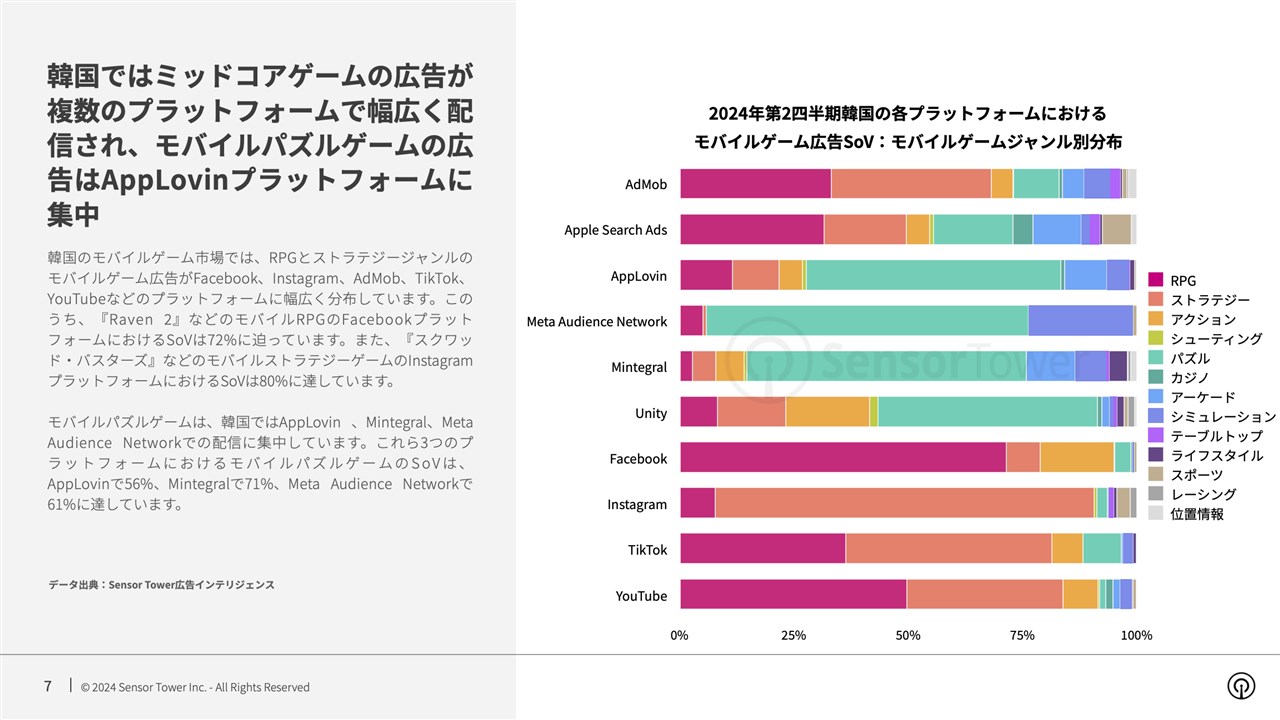

In mobile gaming markets such as the United States, Japan, and South Korea, casual games such as puzzles and casinos are favored for distribution to advertising platforms such as AppLovin, Mintegral, and Meta Audience Network, while mid-core games such as RPGs and strategy games are favored for distribution on YouTube, TikTok, and Meta-related platforms.

In Q2 2024, the SoV of mobile puzzle game advertising in the US will reach 40% according to AppLovin, with Royal Match and Match Factory being the top advertising titles for mobile puzzle games.

In the Japanese and Korean mobile gaming markets, midcore games tend to have a significantly higher advertising SoV than casual games. In Japan, the combined SoV for mobile strategy games and RPGs reaches 72% on YouTube and 90% on Instagram. In Korea, mobile RPGs are approaching 72% SoV on Facebook, while mobile strategy games reach 80% SoV on Instagram.

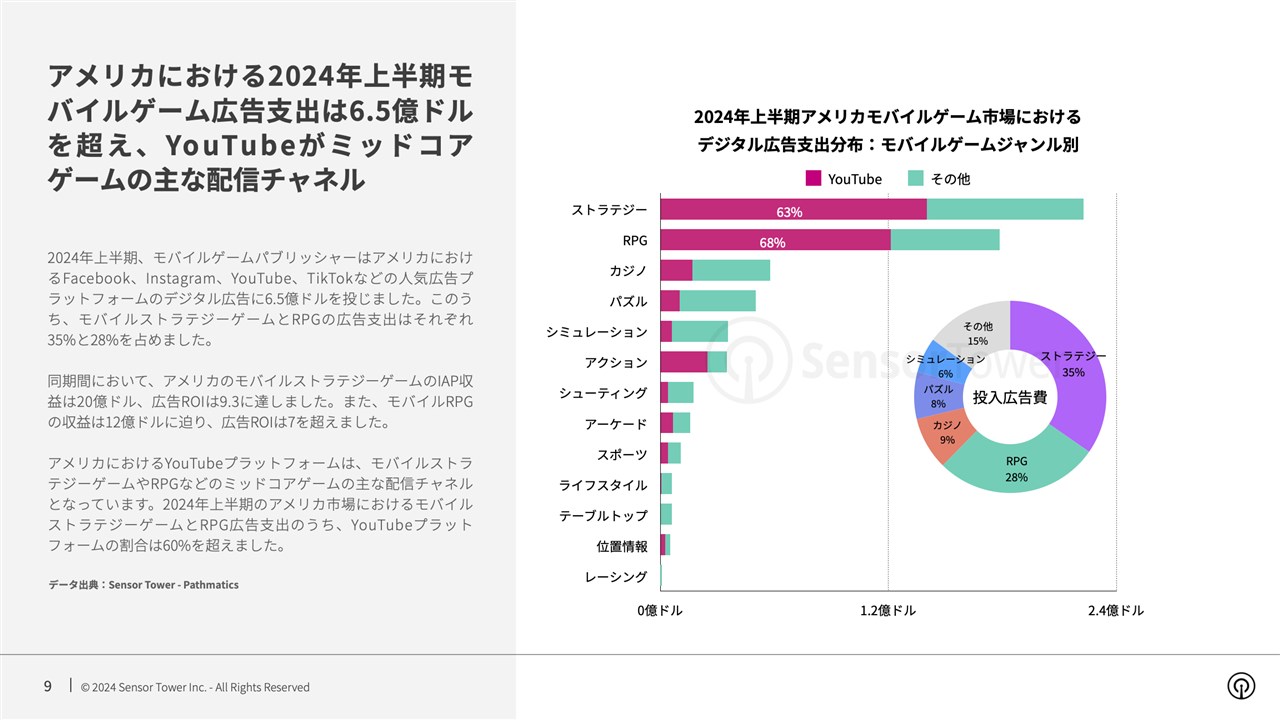

■US mobile game ad spending to exceed $650 million in the first half of 2024

Mobile game publishers will spend $650 million on digital advertising across popular ad platforms such as Facebook, Instagram, YouTube, and TikTok in the US market in the first half of 2024, of which mobile strategy games will account for 35% and RPGs for 28%.

During the same period, US mobile strategy games generated IAP revenue of $2 billion with an ad ROI of 9.3, while mobile RPGs generated nearly $1.2 billion with an ad ROI of over 7.

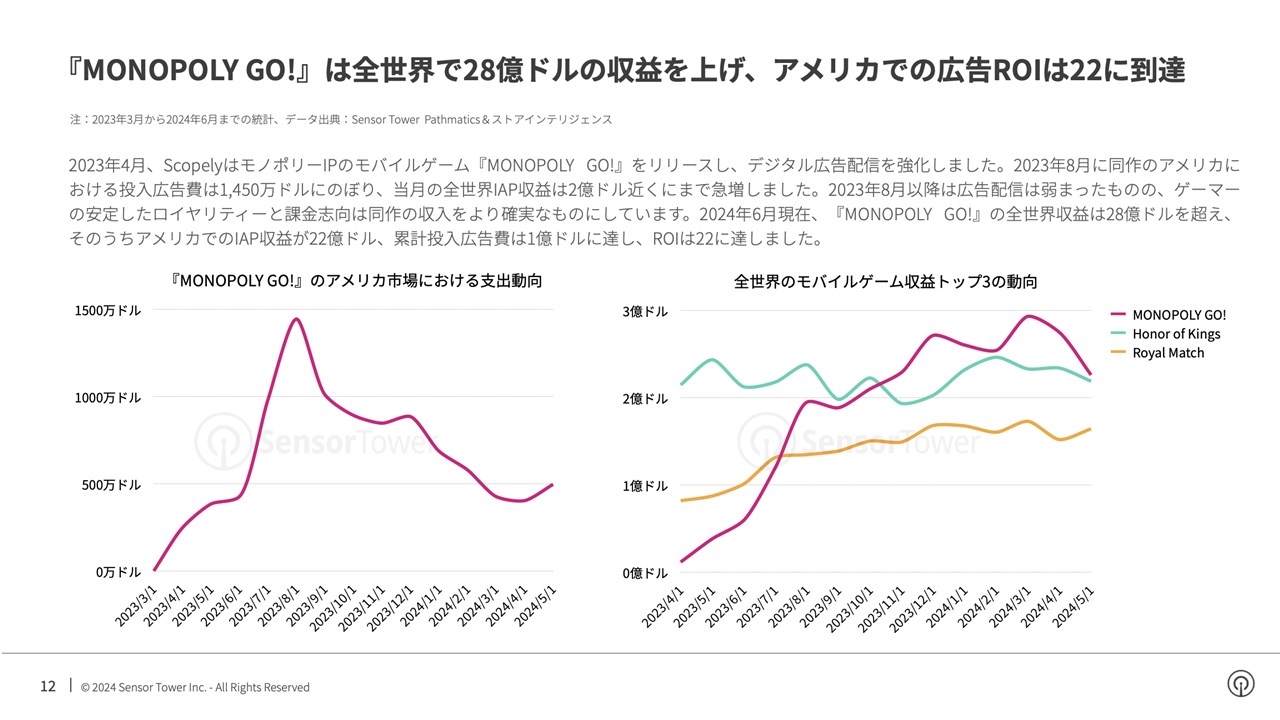

■MONOPOLY GO! grossed $2.8 billion worldwide, with advertising ROI in the U.S. reaching 22

In April 2023, Scopely released the Monopoly IP mobile game “MONOPOLY GO!” to strengthen digital advertising distribution. “MONOPOLY GO!” IAP revenue continues to grow, and monthly revenue exceeded $200 million in October 2023, securing the top spot in the global mobile game revenue rankings.

According to Sensor Tower data, as of June 2024, total digital advertising spend for MONOPOLY GO! in the United States reached $100 million, cumulative IAP revenue reached $2.2 billion, and advertising ROI reached 22.

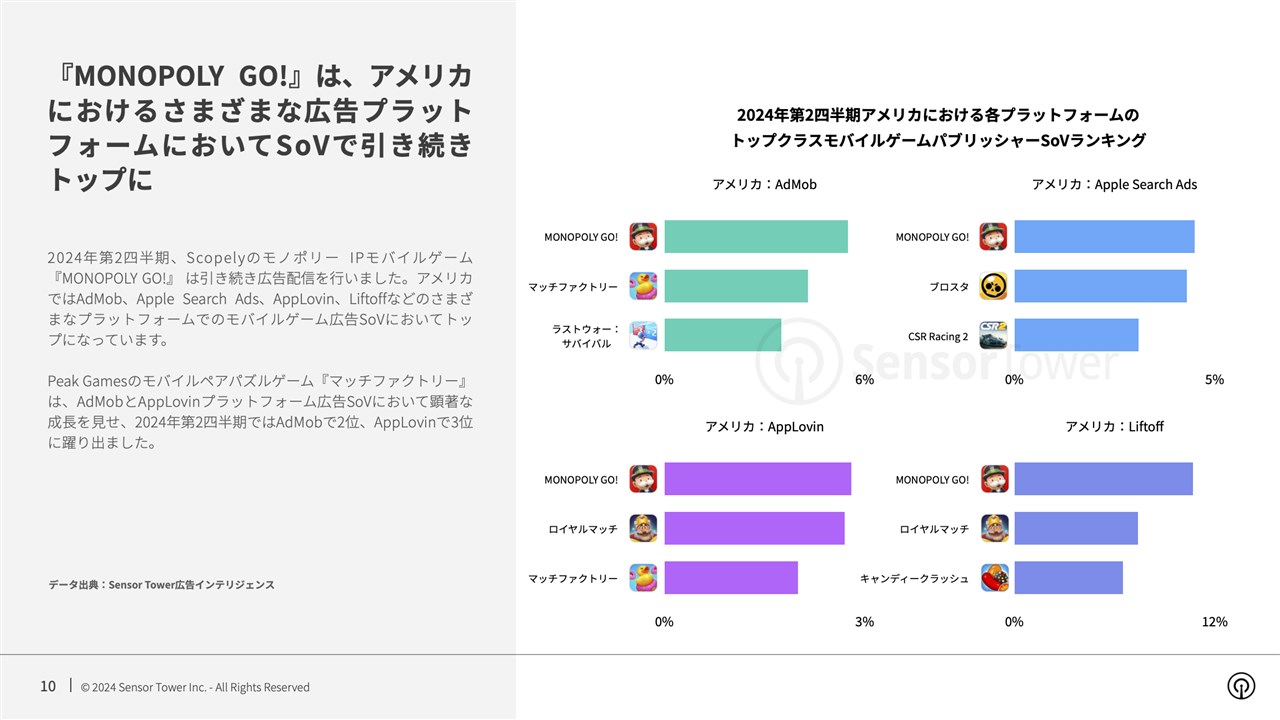

In Q2 2024, MONOPOLY GO! remained the top mobile game in the U.S. by advertising SoV across platforms including AdMob, Apple Search Ads, AppLovin and Liftoff.

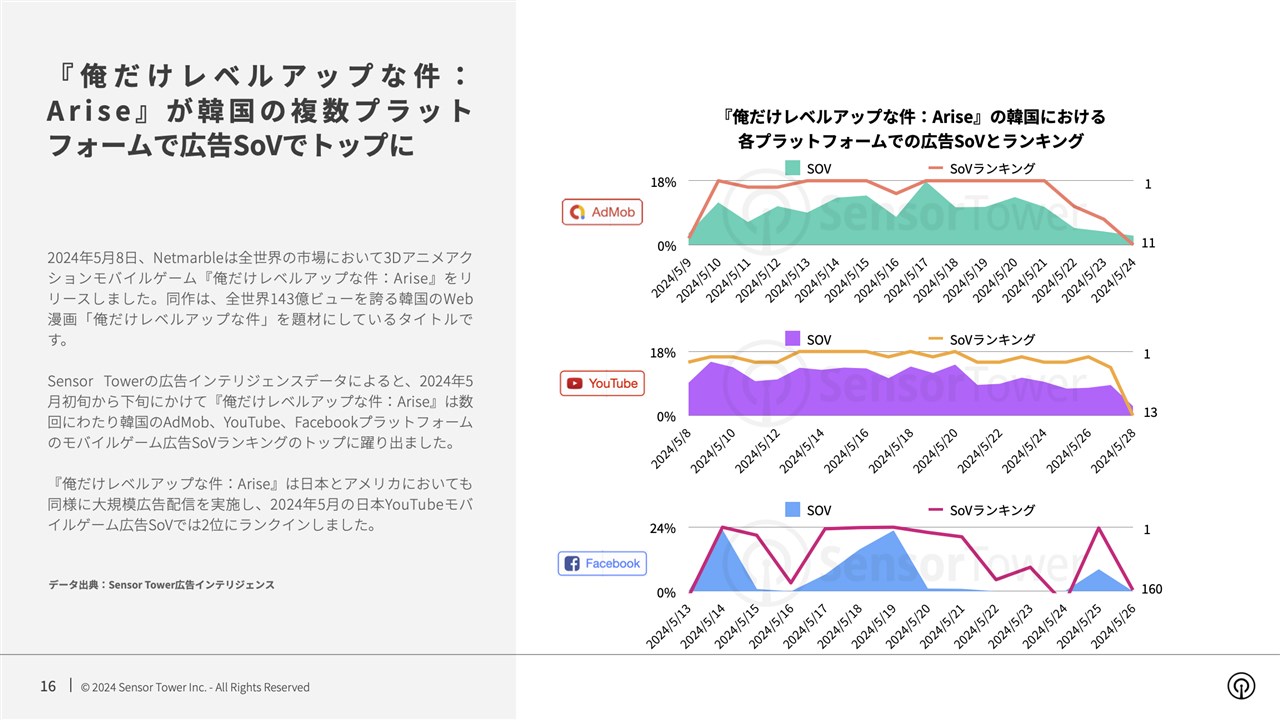

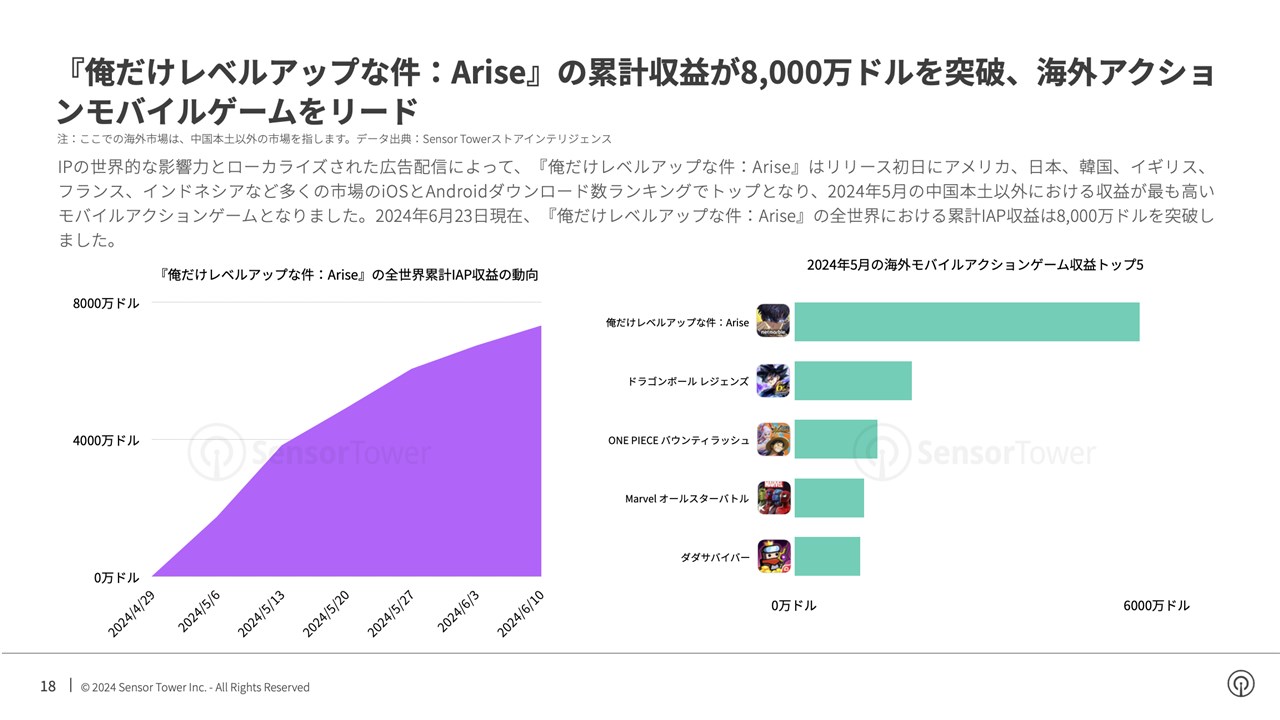

■ “Solo Leveling: Arise” tops advertising SoV across various platforms in Korea

On May 8, 2024, Netmarble released the 3D anime action mobile game “Only I Level Up: Arise” in markets around the world. The game is based on the Korean webtoon “Only I Level Up,” which boasts 14.3 billion views worldwide.

According to Sensor Tower’s advertising intelligence data, from early to late May 2024, “Solo Leveling: Arise” topped the mobile game advertising SoV rankings on Korea’s AdMob, YouTube, and Facebook platforms several times.

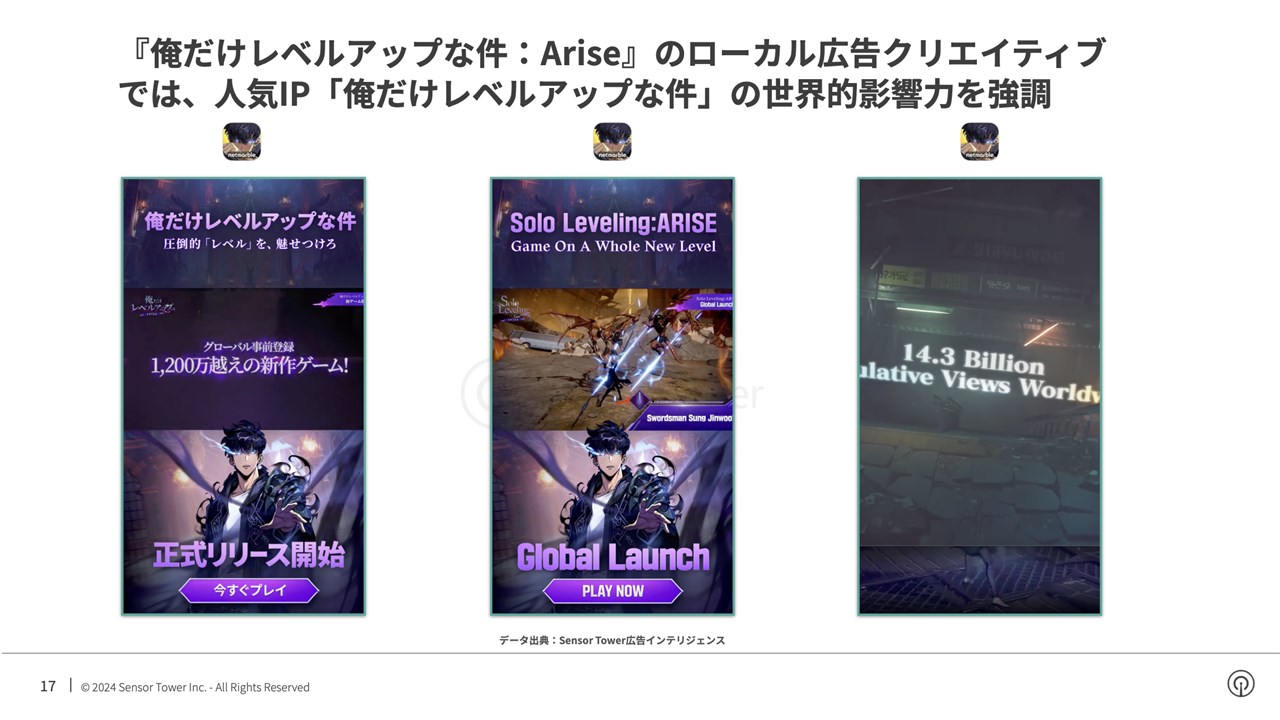

“Solo Leveling: Arise” has a strong impact in markets around the world thanks to its advertising creatives localized in various languages.

As of June 23, 2024, the total worldwide revenue of Only I Level Up: Arise has exceeded $80 million.

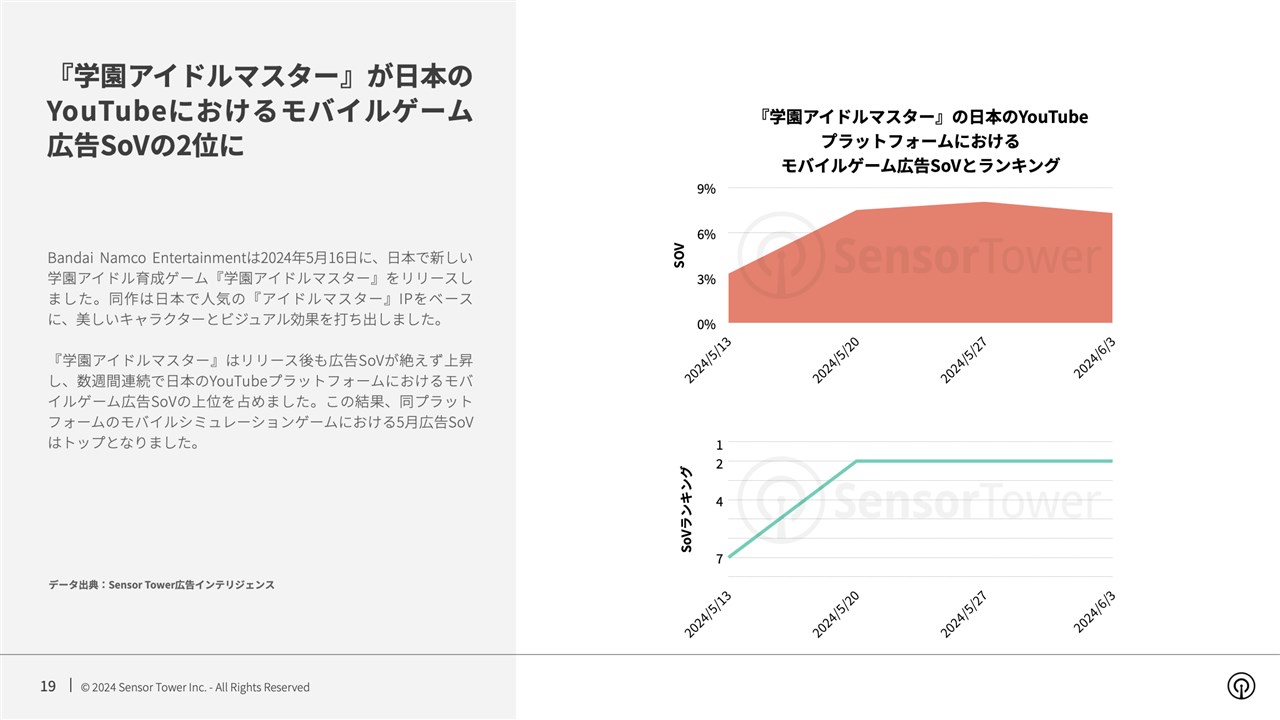

■ “Gakuen Idolmaster” tops YouTube mobile game advertising SoV in Japan

Bandai Namco Entertainment released a new school idol training game, “Gakuen Idolmaster” in Japan on May 16, 2024. The game is based on the popular Japanese “Idolmaster” IP, and features beautiful characters and visual effects. After its release, “Gakuen Idolmaster” saw its advertising SoV steadily rise, and it topped the mobile game advertising SoV on the Japanese YouTube platform for several consecutive weeks. As a result, it topped the advertising SoV for mobile simulation games on the platform in May.

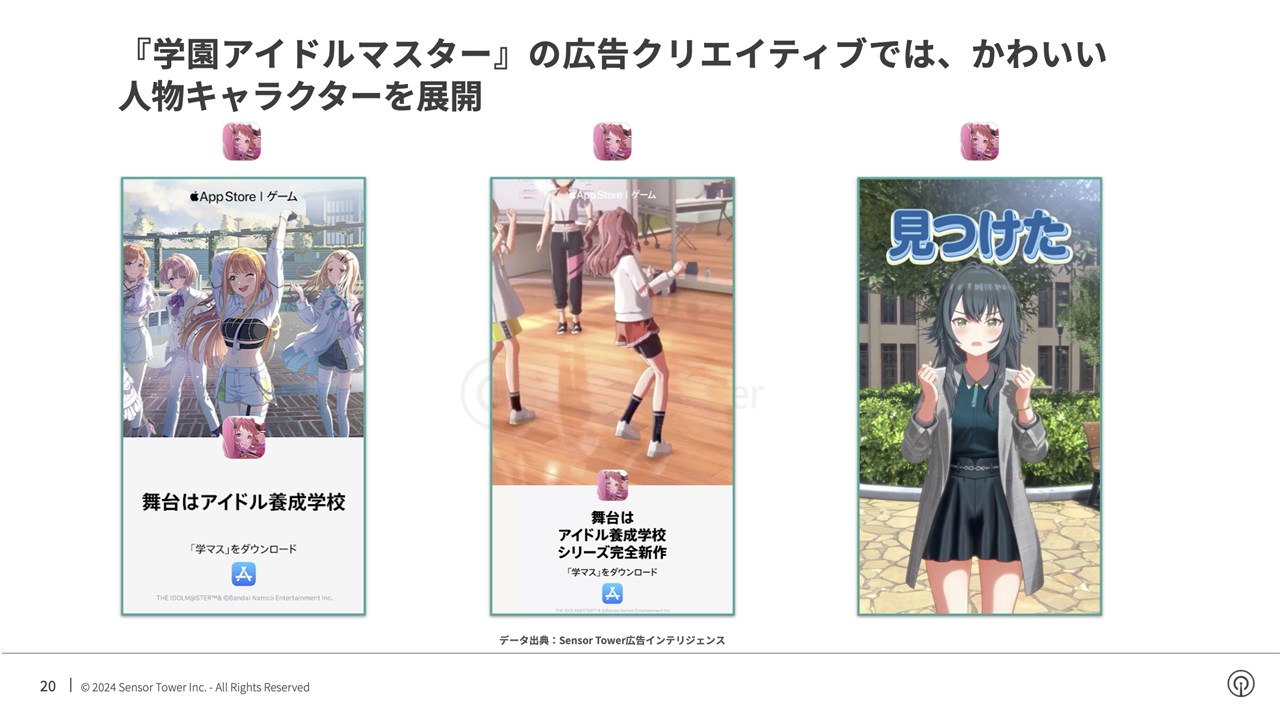

The advertising materials for “Gakuen Idolmaster” are mainly banner ads, and the beautiful two-dimensional art style and cute idol IP characters are eye-catching. In addition, the new school theme has been well received by young gamers, and the game has received 91% of 5-star ratings on the App Store.

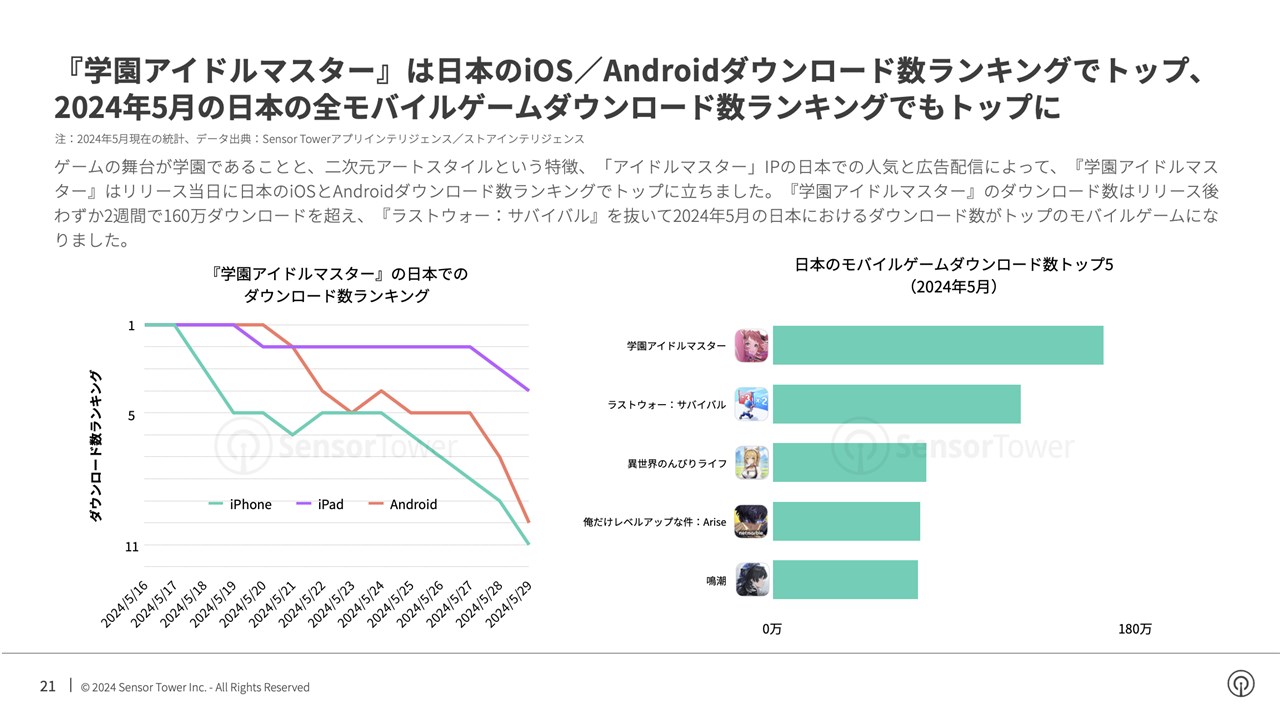

Due to the popularity of the “Idolmaster” IP in Japan and advertising distribution, Gakuen Idolmaster topped the iOS and Android download rankings in Japan on the day of release. Gakuen Idolmaster exceeded 1.6 million downloads just two weeks after release, overtaking Last War: Survival to become the most downloaded mobile game in Japan in May 2024. As a result, Bandai Namco Entertainment saw downloads increase 395% year-on-year and revenue increase 85% year-on-year in the Japanese mobile game market in May 2024.

▼ Download the full report for free

https://sensortower.com/ja/mobile-games-advertising-2024-report-japan