Semiconductor Stock Ranking Japanese Stocks Part 2 High Dividend Yield Stocks with Dividend Yields of 4.6% or More This Fiscal Year | Special Feature | Toyo Keizai Online

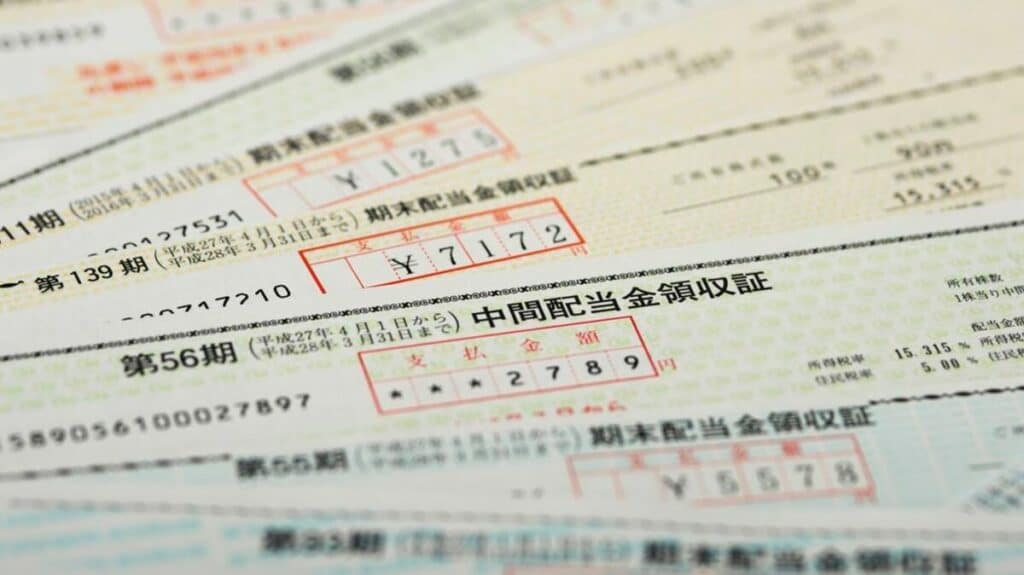

(Photo: jessie / PIXTA)

Read other articles in the special feature “Semiconductor Hegemony”

In response to requests from activists (active shareholders) for shareholder returns, listed companies are increasing or resuming dividends and strengthening share buybacks. It is not uncommon for companies to pay out dividends equal to earnings per share, with a dividend payout ratio of 100%. Some companies have also adopted a “progressive dividend” dividend policy, which means maintaining or increasing dividends for a certain period of time.

In this column, we rank the semiconductor-related companies with the highest “dividend yields” for this fiscal year. Dividend yield is the annual dividend per share divided by the share price. It can be said to be an indicator that makes it easy to compare the rate of return with other financial products such as deposits and bonds.

High Dividend Yield Ranking | Semiconductors + Semiconductor Materials and Parts

This article is available to paid members only.

Log in(For members, click here)

Paid membership registration

If you register as a paid member of Toyo Keizai Online, you will have unlimited access to back issues of Weekly Toyo Keizai and original articles.

- Weekly Toyo Keizai back issues (PDF version) – about 1,000 issues available for unlimited reading

- Unlimited access to over 1,000 original articles from Toyo Keizai

- Get recommended information via email newsletter

- Invitation to exclusive seminars